Everything we do today is mobile, from communication to consuming entertainment, products and services. According to Statista, sales from mobile shopping reached a whopping $2.2 trillion in 2023 and constituted 60% of all e-commerce sales worldwide.

With so much purchasing being done online via mobile, it's a no-brainer for sellers to offer mobile payment systems. This article explores seven of the most popular mobile payment options and explains the benefits they can bring to both customers and your business.

What is a mobile payment system?

Mobile payments refer to online payments made using a mobile device, like a smartphone, wearable device, tablet, or laptop. Rather than paying using a physical credit or debit card, cash, or cheque, customers pay for their purchases digitally using mobile payment technology and secure online applications.

Mobile payments were first adopted in Asia in the 2000s and then became popular in other parts of the world. 2014 saw a notable development in mobile payment solutions when apps like PayPal and Apple Pay introduced a scannable barcode. Users could simply pass their smartphone screen under a store's barcode scanner, and payment would be processed. Later developments have allowed users to simply tap their smartwatch or mobile phone against a contactless credit card terminal.

Since the COVID-19 pandemic, mobile payments have increased even further. Today, customers want and expect mobile payment solutions for shopping (in-store and online), paying bills online and transferring money to others.

Seven popular types and methods of mobile payments

There are several mobile payment options to choose from, each offering advantages and challenges. Here's a brief overview of the main ones…

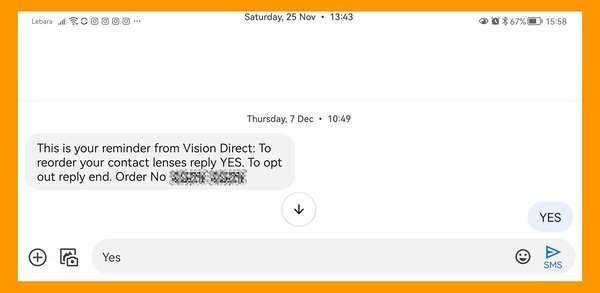

1. SMS payments

SMS payments are a text-to-pay service. As the name suggests, an SMS payment enables customers to pay for a product or service via text message.

Taavi Rebane, Messente’s Head of Marketing, explains why SMS is an excellent mobile payment option: “Text-to-pay is frictionless and fast for customers as they can complete their payment with just a few taps on their phone – either by clicking a URL that takes them to an online payment portal or by confirming the payment with an affirmative response. Reduced friction leads to improved customer satisfaction. SMS payments also offer great accessibility. Even customers without access to the internet or a fancy smartphone can pay via text as SMS is built into all mobile phones.”

To implement SMS payments, it's best to partner with a reliable SMS API provider who can help you set up the service quickly and easily with a two-way SMS message exchange. That's a necessity for this option, as the customer must be able to respond in order to make their payment.

Because text scams are rife, some customers may be suspicious of receiving a payment link via text. However, you can address this potential issue by educating customers on the types of texts they can expect from your business and what they'll look like.

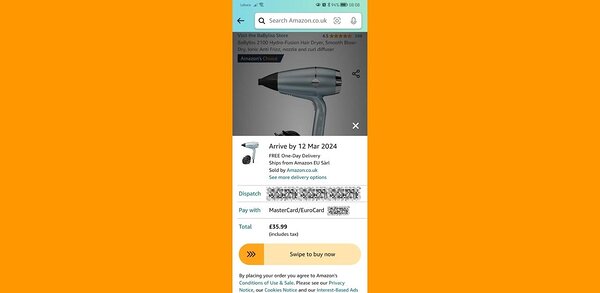

2. In-app payments

In-app payments are when customers pay directly through the app they're using. For example, when you book accommodation through the Airbnb app, you'll pay within the app with a credit or debit card, Apple Pay, PayPal or similar. Amazon is another example that makes it really easy to make a purchase in-app, using stored credit or debit card details.

In-app payments can be vulnerable to security issues since they're conducted via the customer's mobile device. However, by using a trusted payment gateway, implementing two-factor authentication and ensuring your app is always up-to-date, you can reduce the chances of data breaches and fraudulent transactions.

3. Tap-to-pay (NFC payment systems)

Tap-to-pay lets customers pay via a chip card point-of-sale system or card reader that utilises near-field communication (NFC), a short-range wireless frequency. The customer’s mobile device transmits a secure, single-use token to the payment terminal for a specific purchase, and the wireless technology facilitates the data exchange between devices. (The devices must be very close together for tap-to-pay to work.)

Tap-to-pay was widely adopted in the 2010s due to being fast and convenient for both customers and busy retailers. It's also more secure than inserting a card into a chip-and-pin card reader (where payment details can be copied or hacked).

Note that only NFC-enabled devices can take advantage of this solution – some older mobile devices won't support it.

4. Mobile wallets

Mobile wallets are digital systems where you can keep virtual versions of credit and debit cards, loyalty cards – even boarding passes and train tickets. They are a very popular contactless payment method (nearly 50% of global eCommerce payment transactions were done using mobile wallets in 2022).

A mobile wallet enables customers to make in-store payments using their mobile phone or wearable device instead of a physical card or cash. Examples of mobile wallet apps include Google Pay, Apple Pay, and Samsung Pay.

5. QR code payments

Businesses can use QR codes for various purposes, including tracking product inventory, sharing promotional information and capturing subscribers. QR codes are now also being used to process payments (called scan-to-pay).

To use QR code payments, you must first generate a QR code to display at the checkout counter (or on a flyer or website). Then, customers simply scan the code using a digital wallet app like Apple Pay. The amount to pay is shown on-screen and the customer submits payment by tapping a button.

Customers like using QR codes because they are contactless and quite secure (as transmitted payment details are encrypted). However, it's fairly easy for scammers to create QR codes that lead to fake websites designed to capture sensitive details or spread malware. Poor network connectivity can also lead to scanning errors and aborted transactions.

6. Banking apps

Customers can use their bank's official app to make bill payments and individual transfers. Though no system is unhackable, mobile banking apps have the highest security protocols in place, like encryption and biometric authentication. For that reason, most people trust their banking app; in fact, according to one survey, 62% say they can't live without it.

Offering customers the option to pay by bank offers convenience and familiarity. It's a great option for your business if you offer subscription-based services with recurring payments. You should find that transaction fees are lower than card processing fees.

7. Third-party mobile payment apps

Examples of third-party mobile payment apps include PayPal, Venmo, Square, and Zelle. These apps act as intermediaries between the customer's bank and your business. When customers enter their details into your payment portal, the third-party app facilitates the exchange between their payment method and your bank account. Most will let the customer choose from a range of payment methods, e.g., bank account transfer, credit card or eCheque.

Third-party mobile payment apps have simplified the process of international payments. You can now send money securely from Europe to China in a matter of minutes. PayPal is considered a very safe way to pay, as the customer only needs to enter their PayPal email address and password to transfer money. And an app like Square comes with all sorts of payment tools like POS terminals and card readers to allow you to accept in-person payments as well as online purchases.

Of course, there are some challenges. Some mobile payment apps collect and share customer data with other third parties, which could leave users more vulnerable to fraud.

Why you should offer mobile payment options

On the whole, mobile payment solutions are fast, safe and secure. They lead to happier customers and more conversions for your business. Let’s break down some of the key benefits...

Accessibility

These systems allow you to accept mobile payments anywhere, anytime. You don't need to turn any customers away, as you would if you only accepted cash or cheques.

Convenience and speed

Customers expect to be able to make mobile payments. They want a full range of options so they can pay quickly via the method they're most comfortable with (without repeatedly entering their card details). A choice also acts as a backup. For example, if a technical hitch prevents a QR code payment from being processed, you could offer SMS as a fallback.

Security

Although no solution is 100% safe from hacking, a mobile payment service is geared up to be as secure as possible with high levels of encryption, tokenisation and user authentication. (Just check into the data privacy policies of any third-party applications you want to use.)

Higher sales

Having multiple payment options at customers' fingertips helps enhance the customer experience and increase satisfaction. It reduces friction at the checkout and can also cater to impulse purchases, leading to a boost in revenue for your business.

How to choose which mobile payment methods to offer

You might not be able to provide all options at once to your customers, so how do you decide which one(s) to incorporate? Keep the following factors in mind when making your shortlist:

Ease of use - how user-friendly is the interface for customers?

Integration capabilities - how simple is it to build into your payment portal? (Here's how Messente's easy SMS API integration works with any application).

Security protocols - check how your preferred option collects, stores and transmits customer data, what user authentication methods are in place, etc.

Costs - what fees are involved for you or your customers? For example, transaction processing fees or SMS costs.

Popularity - is the mobile payment method already widely used within your customer base and target audience?

Boost customer satisfaction with mobile payments

We live in a mobile-first world where virtually anything can be done using a mobile device, including communication, entertainment, booking appointments, and shopping. Customers expect to be able to make mobile payments using their preferred payment method, whether that's a credit card, bank transfer, Apple Pay or eCheque.

For that reason, it makes sense to incorporate mobile payments into your checkout process. When choosing the right system for your business, consider ease of use and integration, cost, security aspects and popularity with your target audience.

Related reading: check out 32 best tools for eCommerce you must try